Fm Deposit Hold Meaning

FM deposit hold refers to the practice of financial institutions, such as banks and credit unions, of holding onto a customer’s deposited money for a certain period of time, typically between six and twelve months. This practice is designed to discourage customers from withdrawing their money prematurely, in order to avoid losing money on the deposited funds.

Contents

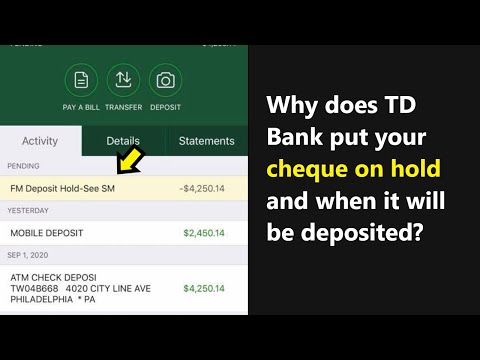

Why does cheque pending with "FM Deposit Hold-See SM" statement in TD Bank? What does it mean?

What is a deposit hold?

When you make a deposit to your account with a financial institution, that deposit is temporarily held by the financial institution as security for the repayment of that deposit. This is also known as a “deposit hold”.

For example, if you deposit $1,000 into your account with a bank, the bank may keep that $1,000 as security until you receive a check or electronic transfer from the bank that reimburses you for that deposited money. If you don’t receive that reimbursement in a timely manner, the bank may release the deposited money to you.

How long does a deposit hold last?

A deposit hold is a holding period that a financial institution may impose on a deposit to ensure its availability for withdrawal. Deposits held for less than 14 days are subject to a hold of less than $10,000 per depositor. Deposits held for more than 14 days but less than 30 days are subject to a hold of up to $100,000 per depositor. Deposits held for more than 30 days but less than 60 days are subject to a hold of up to $250,000 per depositor. Deposits held for more than 60 days are subject to a hold of up to $500,000 per depositor.

What do I need to do to get my deposit back?

There is no one-size-fits-all answer to this question, as the process of getting a deposit back from a financial institution will vary depending on the bank or credit union and the specific situation. However, a few tips on how to retrieve a deposit from a bank or credit union include writing a formal letter requesting the deposit be returned, contacting the bank or credit union directly to inquire about the process, and waiting for a response. If the deposit has already been transferred to another account or is otherwise inaccessible, the bank or credit union may be able to return the deposit to the original account owner in a lump sum or in smaller installments.

I’ve never had a deposit hold before. Is this normal?

Deposits are held when a customer has not made a purchase or when there is an outstanding balance on a purchase. In some cases, a deposit may also be held when a customer is waiting for their card to arrive.

Will a deposit hold affect my credit score?

Deposit holds can have a negative impact on a credit score if you have a history of late payments, defaulted debt, or have other negative credit history factors. Typically, a deposit hold will last for 30 days, but it can be extended if the bank has a legitimate reason to do so. If the bank decides to extend the hold, it will contact you and give you a specific timeframe for when the funds will be released.

How can I avoid deposit holds in the future?

There are a few things that you can do in order to avoid deposit holds in the future. The first is to make sure that you have a good history with your bank. This means that you have been a loyal customer and have not had any issues with your account in the past. If you do have any issues, make sure to contact your bank immediately so that they can work to resolve the issue.

Another thing that you can do is to keep an up-to-date account balance. This means that you make sure that you are always having enough money in your account so that your bank does not need to hold onto your money. If you do have any issues with your account, make sure to contact your bank as soon as possible so that they can work to resolve the issue.

Conclusion

In conclusion, FM deposit hold means that a company is not interested in issuing new shares and is instead holding onto its shares. This may be a sign that the company is not doing well and may need to be sold or restructured.