Fm Deposit Hold See Sm Mean

FM deposit hold means that a financial institution will not allow the withdrawal of funds from a customer’s account until a specific amount of money has been deposited into the account. This is usually done to prevent the customer from withdrawing large sums of money at once, in order to avoid suspicion.

Contents

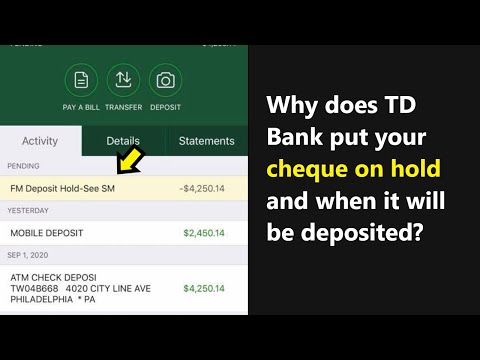

Why does cheque pending with "FM Deposit Hold-See SM" statement in TD Bank? What does it mean?

fm deposit hold: what it is and how it works

fm deposit hold is a term used in financial markets to describe a situation in which a financial institution has taken possession of a security from a customer. In a traditional securities market, a security is a tradable item that represents ownership of a piece of real estate, a company, or a debt security.

When a customer deposits money with a financial institution, the institution typically pledges the money as security for a loan. If the customer does not repay the loan, the institution can sell the security to the highest bidder.

If the customer repays the loan, the institution returns the security to the customer. In rare cases, the institution may keep the security as collateral for the loan.

When a customer deposits money with a financial institution, the institution typically pledges the money as security for a loan. If the customer does not repay the loan, the institution can sell the security to the highest bidder.

If the customer repays the loan, the institution returns the security to the customer. In rare cases, the institution may keep the security as collateral for the loan.

see sm mean: understanding your bank’s lingo

Your bank probably refers to its freepost hold as its “sm” term.

The sm term usually stands for “smooth money.” The idea is that this term is meant to help customers understand the bank’s policy on freepost deposits. Essentially, your bank wants to ensure that your freepost deposits are as smooth as possible.

fm deposit hold: what to do if you’re affected

If you’re affected by the fm deposit hold, the best thing to do is to speak to your bank or the money transfer company. They’ll be able to tell you what to do.

fm deposit hold: how to avoid it in the future

Dear Reader,

I hope you are well! In this article, I will be explaining what fm deposit hold is, what can you do to avoid it in the future, and how you can improve your financial security.

What is fm deposit hold?

FM Deposit Hold is when a bank holds onto your funds for a set period of time, usually between two and four days. This is usually done when the bank is in the process of verifying your identity or when they are awaiting some other form of documentation from you.

Why is fm deposit hold important?

There are a few reasons why fm deposit hold is important. First, it allows the bank to verify your identity and ensure that you are the rightful owner of the funds. Second, it allows the bank to investigate any allegations of fraud or fraudulent activity. Finally, it allows the bank to monitor your account for any unusual or suspicious activity.

Can I avoid fm deposit hold?

There is no one-size-fits-all answer to this question, as each bank may have different policies regarding fm deposit hold. However, there are a few things that you can do to reduce the chances of experiencing fm deposit hold. First, make sure that you have all of the required documents ready to hand when you bank. Second, make sure that your account is fully and properly verified. Third, be aware of any suspicious or unusual activity on your account and report

see sm mean: common banking abbreviations

When talking about a deposit, it is common to see the abbreviation “fm” used. This stands for “finance Minister.”

The fm in this case is referring to the finance minister of the country in which the bank is located. It is not specific to any one bank or financial institution.

Conclusion

Smoke and Mirrors: FM Deposit Holds vs. SM Mean

There are a lot of misconceptions about FM deposit holds and SM mean. Let’s clear some things up.

FM deposit holds are not a guarantee of a certain return. They are simply a way for brokers to lock in a rate for a specific period of time. SM mean, on the other hand, is a mathematical calculation that takes into account the returns of all the funds in an account and calculates the average rate of return.

So, if you’re looking for a guarantee of a certain return, you should consider investing in a CD or a mutual fund. If you’re just looking for an average rate of return, FM deposit holds are a