Fm Deposit Hold See Sm Meaning

If you are looking for a place to store your FM deposit, you may be wondering what the “sm” in “fm” stands for. The “sm” in “fm” stands for “smokeless.” This means that the bank will not allow you to deposit your FM in any smoke-filled environment, such as a casino.

Contents

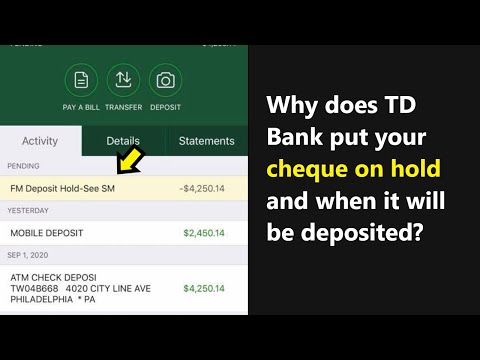

Why does cheque pending with "FM Deposit Hold-See SM" statement in TD Bank? What does it mean?

First, let’s start with fm deposit hold. It is a term used in financial markets to describe the size of a security that a company is willing to sell at a given price.

In the context of stocks, fm deposit hold is the percentage of a company’s outstanding stock that a specific investor is willing to purchase. If an investor is willing to pay $100 per share for a company’s stock, and the company is selling its stock at $105 per share, the investor’s fm deposit hold is 5 percent.

Now let’s look at the term “sm.”

“Sm” is an acronym for “short muscle.”

In the context of stocks, “sm” is short for “short muscle.”

Short muscle is a type of security that is traded on exchanges. When someone sells short muscle, they are betting that the price of the security will decline.

For example, let’s say that you own 100 shares of ABC Company stock. ABC Company is selling stock at $100 per share. You decide to sell short muscle – meaning you sell ABC Company’s stock short, meaning that you believe the stock will decline in price.

If you sell short muscle, you have to borrow the stock from someone else. When you sell short muscle, the stock’s price is lower than the market price. So, if you sell short muscle for $100 per share, the stock’s price will

What is a deposit hold?

A deposit hold is a term used in the world of finance to describe a situation where a company holds onto a certain percentage of the funds that a customer wishes to deposit into their account. This is typically done in order to protect the company from potential losses in the event that the customer is unable to withdraw their funds on time.

What are the different types of deposit holds?

There are four main types of deposit holds:

1. Contractual deposit

This is where a company agrees to hold a certain percentage of an investor’s funds in return for regular interest payments.

2. Fixed deposit

This is where a company pledges to keep a fixed amount of money on deposit with the investor, usually for a fixed period of time.

3. Money market

This is where a company offers investors a high level of liquidity, meaning they can access their money quickly and at relatively low costs.

4. Pre-paid card

This is where a company offers investors the opportunity to invest in a pre-paid card that offers high returns, but requires regular payments.

What is the meaning of “fm” in relation to deposit holds?

The abbreviation fm stands for “freight Maher”, and is a common term in the freight forwarding industry. It refers to a container that is too large to fit through a standard shipping container opening, and must be handled using special equipment.

What are some tips for avoiding deposit holds?

There are a few things that you can do in order to avoid deposit holds. The first is to always ensure that you have enough money available to cover any deposits that you make. This means that you should have enough money saved up in order to cover any deposits that you might need to make on a regular basis. Another thing that you can do is to make sure that you always have accurate information about the bank that you are using. This means that you should always make sure to have accurate account information in order to avoid any deposit holds. Finally, you should always make sure to keep an accurate record of all of your transactions in order to avoid any issues with deposit holds.

What should you do if you see a deposit hold on your account?

If you see a deposit hold on your account, it means that your bank has a hold on your money because it has been flagged as being suspicious. The bank may have received some type of tip from law enforcement that your money may be connected to a crime. Or, the bank may have just received a large deposit that it needs to verify first. In either case, the bank will need a few days to verify the deposit and release the money to you.

What is the best way to avoid deposit holds in the future?

There is no easy answer to this question. However, one option would be to make sure you always have ample funds available in your account in case of a deposit hold. Another approach would be to be proactive about resolving any deposit hold issues as soon as they arise. By contacting your bank immediately, you can often get your money released sooner than if you wait. Finally, always make sure you understand the bank’s deposit hold policies before you make any transactions. By doing your research ahead of time, you can minimize the chances of encountering a deposit hold in the future.

Conclusion

If you’re looking to get your foot in the door with FM radio broadcasting, a deposit hold is a great way to do it. The sm meaning of fm deposit hold is that the station is holding onto your request for a while in order to see if you’re a good fit. This can give you a chance to build a relationship with the station before asking for a broadcast.