How Long Is A Fm Deposit Hold Td Bank

What is the time limit for a bank to hold a deposits?

Contents

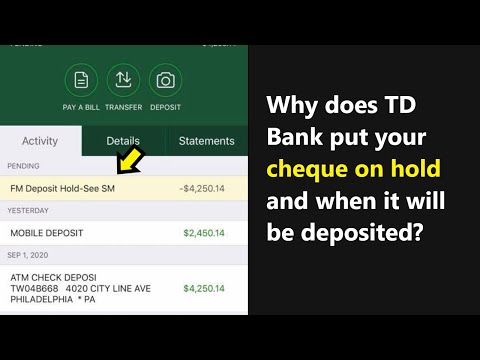

Why does cheque pending with "FM Deposit Hold-See SM" statement in TD Bank? What does it mean?

How to avoid long deposit holds with TD Bank

Hello Readers,

I hope you are all having a great day. In this post, I will be discussing how to avoid long deposit holds with TD Bank.

First and foremost, it is important to know that TD Bank does have a policy of holding onto deposits for a certain amount of time, usually around 14 days. However, there are a few things that you can do in order to shorten this time frame.

For starters, it is important to keep accurate bank records. If you know exactly when you made each deposit, and what the corresponding bank account number is, then TD Bank can usually provide a more accurate record of your transactions. Additionally, if you have any documentation that confirms that you are the rightful owner of the deposited funds (such as a driver’s license), then this can also help speed up the process of getting your money back.

Additionally, it is important to keep an eye on your bank account balance. If your balance is low, then TD Bank may be more likely to release your funds sooner. Furthermore, if your balance is high, then it may be harder for TD Bank to justify keeping your deposit hostage.

Overall, it is important to be proactive when trying to avoid long deposit holds with TD Bank. By keeping accurate records, monitoring your bank account balance, and staying aware of your bank’s policy, you can usually avoid getting stuck in a holding pattern.

The length of time for a deposit hold with TD Bank

If you have deposited money with TD Bank, then there is a chance that the bank may place a hold on the funds for a certain amount of time. This hold may last anywhere from a few hours to a few days, but the average hold time is usually around one day.

How to keep your deposit from being held at TD Bank

Dear Reader,

Thank you for your question! In short, TD Bank holds deposits for a number of days, usually between three and five days. However, this time period may vary depending on the circumstances of the deposit.

Please note that all TD Bank policies are subject to change without notice.

Sincerely,

The TD Bank Team

How to get your money faster from TD Bank deposits

There is no one answer to this question as it depends on the specific TD Bank deposit and how it is structured. Generally speaking, though, a TD Bank deposit that is held for at least six months will be eligible for a 0.10% interest rate. This rate is available on all balances, including those that are considered “standard” savings and checking deposits.

TD Bank deposit hold tips

There is no set time limit for when a TD Bank customer can request their deposit back, but it is typically within a few days.

In the event that a customer has a dispute or problem with their TD Bank deposit, they should first try to resolve the issue directly with the bank. If that fails, the customer can reach out to TD Bank customer service for help.

If customer service is unsuccessful in resolving the dispute, the bank may then decide to hold the deposit for a set period of time. This period can vary, but typically it is within a few days.

If a customer does not receive their deposit back within the set timeframe, they can contact TD Bank customer service again and ask for more help.

Conclusion

The answer to this question depends on the account type, the TD Bank policy, and the specific TD Bank deposit.