What Does Fm Deposit Hold Mean Td Bank

There are a few things to know about FM deposit accounts at TD Bank.

First, FM deposit accounts are FDIC insured up to $250,000. This means that if something goes wrong with your account, TD Bank will help you get your money back.

Second, TD Bank pays interest on all of its FDIC-insured deposits. This interest is paid daily and is calculated according to the daily interest rate offered by the Fed.

Finally, TD Bank offers a number of different FDIC-insured products, including:

– Individual Savings Accounts (ISAs)

– Certificate of Deposit (CDs)

– Money Market Accounts

– and more.

Contents

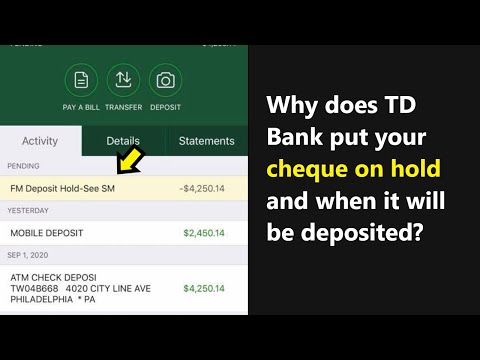

Why does cheque pending with "FM Deposit Hold-See SM" statement in TD Bank? What does it mean?

FM deposit means that you are depositing funds in a financial institution through a trust deed. This will give you more security and peace of mind when dealing with your money.

What is an FM Deposit Hold?

When a financial institution holds onto a deposit, it is doing so in the hope that the depositor will eventually return the funds. If the depositor does not return the funds within a certain period of time, the financial institution may place a hold on the funds in order to protect itself.

How does it work?

FM deposit, also known as Fixed Deposit, is a term used in the banking and financial industry to refer to a type of deposit account that allows customers to receive interest on their deposited funds. These accounts are typically offered by commercial banks and some credit unions, and are one of the most common types of savings accounts in the United States.

To understand how a FM deposit works, let’s take a look at the basic structure of a bank account. When a customer opens a bank account, the bank deposits the customer’s money into a special account called a checking account. The bank then loans the customer the excess money (if any) deposited in the checking account, which the customer can use to withdraw cash or make deposits into other accounts.

A FM deposit account is similar to a checking account, but the main difference is that the bank pays the customer interest on the deposited money. This interest is usually known as the bank’s “annual percentage yield.”

The annual percentage yield on a FM deposit account is usually a bit higher than the interest rate on a checking account because the bank assumes that the money deposited will be there for a longer period of time. This is why it’s important to keep track of your bank’s interest rates and compare them to the rates offered on FM deposit accounts to make sure you’re getting the best deal.

If you’re interested in opening a FM deposit account, be sure to talk to your bank about its rates and terms. You

Why does TD Bank use them?

FM deposit holds are a way for TD Bank to keep track of how much money its customers are depositing. This information is used to help TD Bank decide how much money to lend to its customers.

What are the benefits?

FM deposit is an account that allows you to save money in your own account. It also allows you to access your savings quickly and easily.

What are the drawbacks?

In layman’s terms, FM Deposit is a term used to describe a savings account with a higher interest rate than a regular savings account. This higher interest rate is typically offered to those who have a higher credit score, or to those who have a higher amount of deposited money. However, there are a few drawbacks to having an FM Deposit account. For one, FM Deposit accounts are usually limited to a certain amount of money that can be deposited each month. Additionally, FM Deposit accounts typically have a higher minimum deposit requirement than regular savings accounts.

Conclusion

According to TD Bank, FM deposit holds represent a liquidity issue for the institution. The TD Bank release goes on to say that the deposit holds are indicative of an institution’s need for more capital. The release also notes that the deposit holds could affect the institution’s ability to provide the necessary liquidity to its customers.