What Is A Fm Deposit Hold

A FM Deposit Hold is a policy that banks use to reserve funds against potential future deposits. This policy is used to protect the bank’s balance sheet by reducing the amount of money that the bank needs to hold in reserve.

Contents

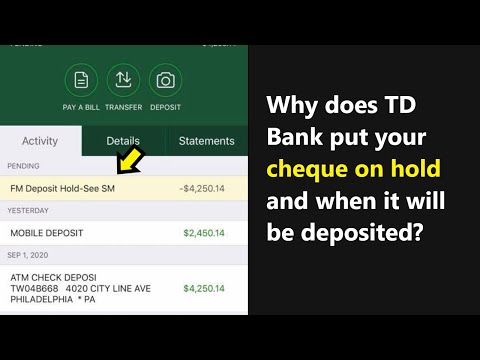

Why does cheque pending with "FM Deposit Hold-See SM" statement in TD Bank? What does it mean?

What is a fm deposit hold?

A FM deposit hold is a term used in the finance world to describe a situation where a company has placed a hold on a customer’s funds. This hold is usually in place to prevent the customer from withdrawing their funds from the company’s account.

How do fm deposit holds work?

A fm deposit hold is a technique used by banks and other financial institutions to ensure that a customer’s account is kept open even if the customer does not make a payment on time. Basically, a fm deposit hold is a hold on a customer’s account that is placed by the bank in order to ensure that the customer does not have to worry about not being able to access their account until their payment is finally received. The bank will usually release the hold once the customer’s payment is received and has been processed.

What are the benefits of a fm deposit hold?

There are many benefits to having a fm deposit hold. A fm deposit hold can provide an investment vehicle that has high returns with little risk. It also allows investors to hold their investments for a long period of time, which can provide stability and peace of mind. Finally, a fm deposit hold can be a great way to access high-yield investments.

What are the risks of a fm deposit hold?

A fm deposit hold is a technique used by some fraudsters to dupe their victims. This is a type of scam in which fraudsters pose as trusted individuals or entities, such as banks or government departments, and convince their victims to make a deposit in order to receive a specific service or product. Once the victim makes the deposit, the fraudster may never follow through with the promised service or product, potentially resulting in a loss for the victim.

The risks of a fm deposit hold are many and varied. Victims may be misled into believing that the deposit is safe and will not be used to commit fraud, only to later find out that their money has been lost. In addition, the fraudster may use the victim’s money to commit other crimes or to fund their own illegal activities. Finally, the victim may not be able to get their money back if the fraudster fails to follow through with their promises.

How can I avoid a fm deposit hold?

There is no one definitive answer to this question, as it will depend on the specific circumstances of your situation. However, some steps that may help to avoid a fm deposit hold include:

1. verifying the accuracy of the details provided about the company and its products/services

2. ensuring that you are comfortable with the terms and conditions of the fm deposit

3. reading the fm deposit hold blog section carefully to understand the risks and potential consequences of a fm deposit hold

4. investigating the company’s financial stability and credibility

5. verifying that the fm deposit is a suitable investment for your needs and goals

6. consulting with a financial advisor if you have any questions or concerns about the fm deposit

7. maintaining good communication with the company and documenting any interactions and/or problems that you encounter

Conclusion

A fm deposit hold is a security that guarantees a certain return on investment. It is typically used by companies to secure funds from investors in advance.