What Is Fm Deposit Hold See Sm Td Bank

The FDIC estimates that there are more than $60 billion of uninsured deposits at institutions that are not required to hold them in reserve. This is what is known as a deposit hold see sm td bank.

Contents

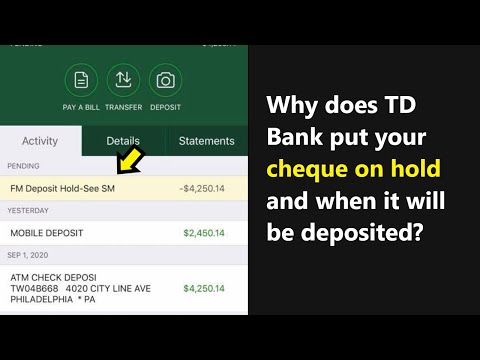

Why does cheque pending with "FM Deposit Hold-See SM" statement in TD Bank? What does it mean?

What is a bank deposit hold?

A “FM Deposit Hold” is an industry term that refers to a situation where a bank limits the amount of funds that can be deposited into a customer’s account. Typically, this occurs when the bank has reason to believe that the customer may not be able to afford to repay their loans in a timely manner.

How do bank deposit holds work?

FM deposit holds are simple but efficient ways of keeping money in a bank account. Essentially, they work like a cash advance, letting you withdraw money from your account immediately without having to wait for a check to clear. The key difference is that, unlike a cash advance, you don’t have to pay interest on your deposit hold.

How an FM Deposit Hold Works

To use an FM deposit hold, you first need to open an account with your bank. Next, you need to contact your bank and request a deposit hold. You’ll need to provide your bank with the following information:

Your account number

The amount of money you want to deposit

The date you want the hold to start

Your bank will then initiate the deposit hold and return your requested money to your account within a few days.

Advantages of an FM Deposit Hold

There are a few advantages to using an FM deposit hold. First, it’s a quick and easy way to get money out of your bank account. Second, interest on your deposit hold is free. Finally, you can use your deposit hold any time, day or night.

Disadvantages of an FM Deposit Hold

There are a few disadvantages to using an FM deposit hold. First, you can’t use your deposit hold to withdraw money from your account in the event of a bank emergency. Second, you can’t use your deposit hold to make large withdrawals. Finally, you

What are the benefits of bank deposit holds?

An FM Deposit Hold is a way to temporarily reduce the amount of funds available to a bank account. It is typically used when the bank is waiting for a payment to clear. The bank will hold the funds in the account until the payment clears.

What are the drawbacks of bank deposit holds?

There are many benefits to having a FM Deposit Hold with your bank. Not only do you get to earn interest on your deposited funds, but you can also use the hold to secure your money in case of an emergency. Additionally, the hold can protect your deposit from being withdrawn by another bank or individual until you are ready to release it. Finally, a FM Deposit Hold can also provide peace of mind in knowing that your money is safe and secure.

How can I avoid bank deposit holds?

There are a few potential drawbacks of holding an FM deposit. The first is that it can tangle your finances if you don t have enough money available to withdraw. Second, if the bank fails, your deposit may be lost along with any money you deposited. Finally, if interest rates drop, the amount of interest you re earning on your deposit may decline.

What is the best way to deal with bank deposit holds?

If you’re considering whether or not to place an FM Deposit Hold at your bank, it’s important to understand the different types available and decide which is best for you.

There are two common types of FM Deposit Holds:

1. A Cash Deposit Hold allows you to hold onto your cash until it’s transferred to your bank account. This is great if you’re waiting for a payday and don’t want to spend your money until you have the funds in your account.

2. A Time Deposit Hold allows you to keep your money in your account but prohibits you from withdrawing it until a set date. This is good if you want to save your money for a long period of time, but don’t want to tie up your checking account.

Conclusion

The FDIC insures funds up to $250,000 per depositor. That means that if you have $250,000 in your account at a FDIC-insured bank, your bank is legally required to hold onto your money until you ask for it back. If you need your money sooner, you can ask the bank to release the money “on demand.”