Fm Deposit Hold-see Sm How Long

The FM deposit hold-see sm how long option is a great way to ensure that you always have enough money in your account to cover any unexpected expenses. This option allows you to hold onto your funds for a set amount of time, after which the money will be automatically transferred to your account. This way, you never have to worry about running out of money, and you can always have access to your funds when you need them.

Contents

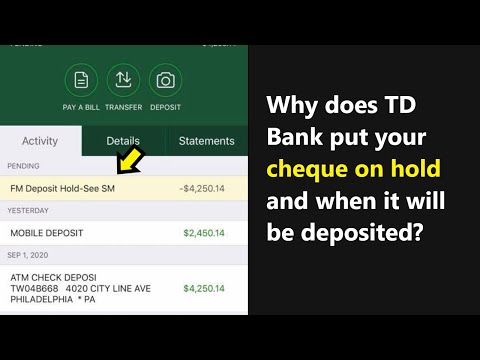

Why does cheque pending with "FM Deposit Hold-See SM" statement in TD Bank? What does it mean?

How long is the average deposit hold?

fm deposit hold is the time taken for the bank to process a deposit. Most banks will take around 5-7 business days to process a deposit.

What are the most common reasons for deposit holds?

Deposit hold is the term used for when a customer has put money into their account and the bank is waiting for the funds to clear. Deposit holds can be caused by a variety of things, but the most common reasons are:

- A customer has insufficient funds in their account

- The bank is waiting for documents from the customer

- The customer has a pending loan or credit application

There are a number of things that a bank can do to speed up the process of clearing a deposit hold. Some banks will automatically transfer the money from the customer’s account to a separate account that the bank has set up specifically for deposit holds, while others will require the customer to fax or mail documents to the bank. In some cases, the bank may even be able to clear the deposit hold directly from the customer’s account.

How can I avoid deposit holds?

Deposit holds can be avoided by following a few simple steps.

1. Make sure you have all the necessary documentation to proof your identity.

- Make sure you have all the necessary documentation to proof your income.

- Make sure your account has been opened and funded in a timely manner.

- Always keep your account information confidential.

If you follow these simple steps, you will most likely avoid any deposit holds.

What is the best way to deal with deposit holds?

First and foremost, it is important to remember that deposit holds are not always an act of malice or intentional withholding of funds. Sometimes, banks may experience a backlog of transactions and need more time to process your deposit. In these cases, your bank may simply need more time to verify your information, and they will contact you to let you know the status of your deposit.

If your bank has not contacted you after a few days, or if you suspect that your bank is withholding your deposit for malicious reasons, you can reach out to your bank directly. You can do this by calling customer service, writing a letter, or sending an email.

In general, it is a good idea to keep a positive attitude and be polite when dealing with your bank. You can also try to remind your bank that you are a loyal customer and that you would like your deposit released as soon as possible. If you feel that your bank is not acting reasonably, you can escalate the situation by contacting your local media or your bank’s regulator.

How long should I expect my deposit hold to last?

Deposits held in your account will usually last between two and four weeks, but this can vary depending on the bank.

Conclusion

If you are considering investing in FM deposit schemes, it is important to understand how long your money will be held before it is released to you. Some schemes hold your money for a set period of time, while others allow you to withdraw your money at any time. It is important to research the particular scheme you are considering, so that you can make an informed decision.