What Does Fm Deposit Hold-see Sm Mean Td Bank

What does Fm Deposit Hold-see Sm mean?

fm deposit means the amount of money that you deposit into your account at a financial institution. The letter “F” stands for “five” and “m” stands for “million.” “Sm” means “million.”

Contents

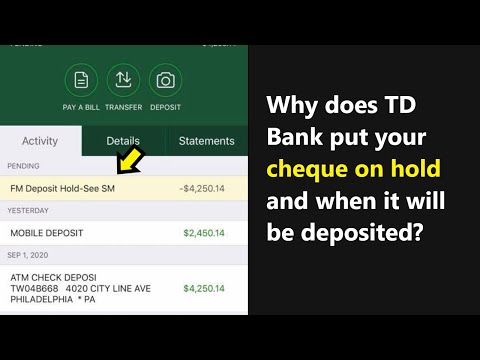

Why does cheque pending with "FM Deposit Hold-See SM" statement in TD Bank? What does it mean?

FM deposit means a financial institution that deposits funds into a checking or savings account.

What is an FM Deposit Hold?

A fm deposit hold is when a bank places a hold on a customer’s funds in order to prevent the customer from withdrawing their money. This is done in order to protect the bank and its customers from fraudulent activity.

What does “see SM” mean?

FM deposit refers to a bank account with a fixed deposit option. A fixed deposit is a deposit that is guaranteed by the bank and pays a fixed interest rate.

How does this affect TD Bank customers?

FM deposit holds are actually deposits that are held by financial institutions, similar to savings accounts. This means that, generally, when a customer withdraws money from their FM deposit, the bank will give the customer back the same amount of money that was deposited plus any interest that has accrued. This is different from a TD Bank savings account, for example, where the bank keeps all of the interest that is earned.

What are some alternatives to an FM Deposit Hold?

Some alternatives to an FM Deposit Hold are a Fixed Deposit, a Time Deposit and an Annuity.

What are the benefits of an FM Deposit Hold?

An FM Deposit Hold can be a great way to save money on your bank account. When a bank holds your money, they are able to lend it out more cheaply than if they were just giving it out to other people. In addition, if there is ever a problem with your bank, they will be able to quickly and easily grab your money to cover any losses.

Conclusion

The FDIC regulates banks and their deposits. The FDIC defines a bank as an institution that:

-Is a national banking association or a state member bank

-Is insured by the Federal Deposit Insurance Corporation

-Is engaged in retail or commercial banking

The FDIC defines a savings association as an institution that:

-Is a state-chartered or federally chartered institution that is not a bank

-Is insured by the Federal Deposit Insurance Corporation

-Is engaged in savings activities

The FDIC defines a thrift as an institution that:

-Is a state-chartered institution that is not a bank

-Is insured by the Federal